Holland Corbett is a FinTech entrepreneur and art consultant who combines the best of both worlds in his work. As a founder of One Away Partners, an art advisory firm and innovation hub, he believes the art market requires fundamental transformation.

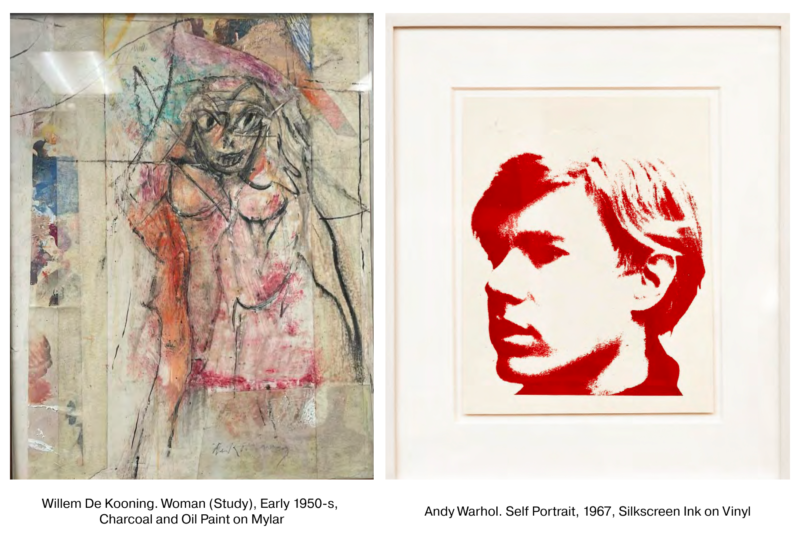

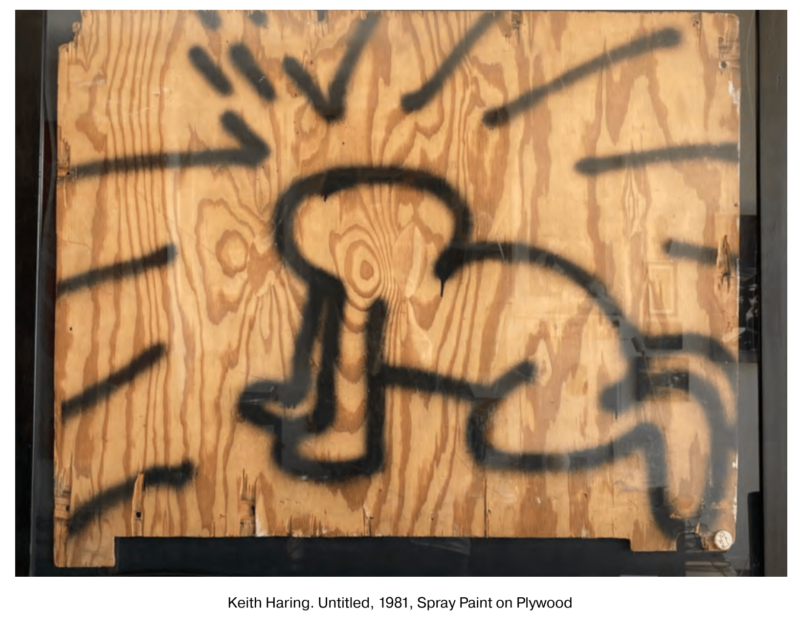

In line with his vision, he started collaborating with the prominent Leila Heller Gallery based in New York and Dubai. Their most recent joint project, the Expansive Change exhibition, features a plethora of celebrated names from Jean Dubuffet to Mark Rothko, Andy Warhol, Keith Haring, Takashi Murakami, and Dmitri Cherniak, covering a century of contemporary art from 1920 to 2020. On view until August 30, it was curated by Santiago R. Guggenheim. The show has been dubbed his triumphant return to New York City’s gallery scene.

In an interview with Fine Art Shippers, Holland Corbett shared his perspective on the current state of the art market, collecting, and ways to democratize access to blue-chip art for the broader public.

Holland Corbett on the Democratization of the Art Market

Could you briefly tell us how you started in the art industry?

Holland Corbett: When I was in university, I started in FinTech and founded a company called Myperfi (My Personal Finance), a budgeting platform for college students. In my second year, I managed to raise some funds for the project, which allowed me to focus on my interests. So I decided to study history and philosophy instead of business, despite my family’s advice against it.

At that time, a close friend of mine, Nick Delgado, started Impact Art Gallery and asked for my help in structuring it as a business. This introduced me to the art world from a business perspective, and I found it fascinating how artworks could sell for high prices.

I began to explore how people conceptualize value and why the wealthiest individuals spend the most on art. I discovered that since 2017, art has become a significant alternative asset class. I realized that the art world is like the Wild West of capitalism, with immense value but also bad actors and money laundering. This led me, along with my business partners Trevor Ruegg and Santiago Rumney-Guggenheim, to establish One Away Partners in San Francisco in 2019.

We realized that San Francisco had some of the wealthiest people in the world, but one of the most underdeveloped collector communities with no blue-chip galleries. We saw this as an opportunity to engage with tech people who didn't see the value in investing in art. In 2020, we created our own metrics in order to bridge the gap between the subjective and objective conceptualization of value and meaning and developed a thesis based on them.

What are the focus and goals of One Away Partners?

One Away Partners is an international multi-disciplinary strategic advisory firm and innovation hub focused at the confluence between Arts, Tech, and Strategy. Our three main business sectors are Art Industry Advisory, Digital Transformation, and Innovation Lab & Incubator.

How did you come to collaborate with Leila Heller Gallery?

In 2021, during the COVID lockdowns, Dubai remained open. That's when I met Leila Heller, whose gallery has spaces in New York City and Dubai. We spent about two months in the UAE, meeting with the Ministry of Culture to discuss their efforts to attract more Western visitors and make Dubai a more appealing destination through art.

While working with Leila, we focused on the secondary market and had a lot of success sourcing various paintings. When Leila decided to host a secondary market show in New York this year, she reached out to us to help curate it. We connected her with Santiago Guggenheim, the great-grandson of Peggy Guggenheim, who did a fantastic job putting the show together.

What personal meaning does working with the Leila Heller Collection on the Expansive Change project hold for you?

I find it fascinating to explore the interconnected nature of everything, especially in art. The collection, which showcases the evolution of modern and contemporary art from cubism to digital forms, highlights that there's no real separation between those living in the physical world and the new generation that has grown up in the digital realm. Art is a universal language that connects us all. Its value depends on how widely and compellingly its story is shared, and passionate collectors like Leila Heller play a crucial role in this.

What do you think about the potential of digital art? Is it likely to replace its analog predecessor?

The main issue with digital art is that it doesn't foster the same connection as physical art. As a collector, the art you choose to display shapes your environment and your identity. Surrounding yourself with art that resonates with you is powerful for personal development. I believe all art has validity, even if it's not to my taste.

Appreciating diverse art forms enriches one's personality. I know many collectors with years of experience, and I can say they have a deeper sense of self. I recall the 2021 Art Basel Miami, where crypto billionaires tried to buy art but were put on long waiting lists. It was a moment of realization that money alone cannot grant you access to iconic artists. You need to have a name in the collector community and a history of meaningful collecting to unlock access to the contemporary masters of our time.

What is your take on the current state of the art market?

I believe that the current situation with the art market is fundamentally wrong. Galleries often have corrupt practices, selling only to well-connected individuals who can later resell for a massive profit. This corruption is why I've largely stepped out of the secondary market until there's some standardization. The current system allows people to manipulate the market for personal gain. We need regulations to prevent illegal resales and ensure the integrity of the art market, which lacks an international regulatory body to enforce rules.

What market transformations could change the situation you described?

Fractionalization, a concept gaining traction since 2017, has the potential to transform the art market. Companies like Masterworks illustrate this trend. Masterworks is a platform that allows you to invest any amount of money in multi-million dollar artworks by renowned artists such as Basquiat, Picasso, and Banksy. Fractionalization is undervalued right now, but I believe it can become a real game-changer in the art world, not only from a financial perspective but also by contributing to art education and appreciation among the broader public. However, the full realization of this broader reach will only happen if we have transparency and proper regulation to prevent malpractice in the industry.

Take Gerhard Richter, my favorite artist. A collector who bought a work in the 1970s for about 600 francs could now have it valued at several million dollars. Instead of selling it outright, they could use a fractionalization platform to sell a portion of the artwork. Suppose Sotheby's gives an estimate of $4 million–$6 million. The collector could sell a 25% ownership stake to other Richter lovers at a low estimate, allowing the collector to recuperate $1 million, with a contract to sell the work in five years. This would provide the needed liquidity while giving retail investors a chance to enter at the lower estimate. This creates a win-win situation: new collectors can benefit from high market returns, and current collectors gain access to liquidity solutions without undermining hard-fought price increases via flooding supply beyond the demand.

This approach could stabilize the market and prevent the kind of devaluation we're seeing with artists like George Condo. His market surged until 2022, but an oversupply of primary shows has led to a steep decline in secondary market prices. Many owners are now selling at lower prices because they didn't hold onto their works long enough to maintain their value.

What other steps do you think would help democratize the art market?

I've worked with older collectors who have amazing collections, but whose kids don't appreciate the art. They want these works to be shared with the world. As a result, we're seeing more art foundations and museums being created each year. This, combined with technology, can democratize both access to and ownership of art.

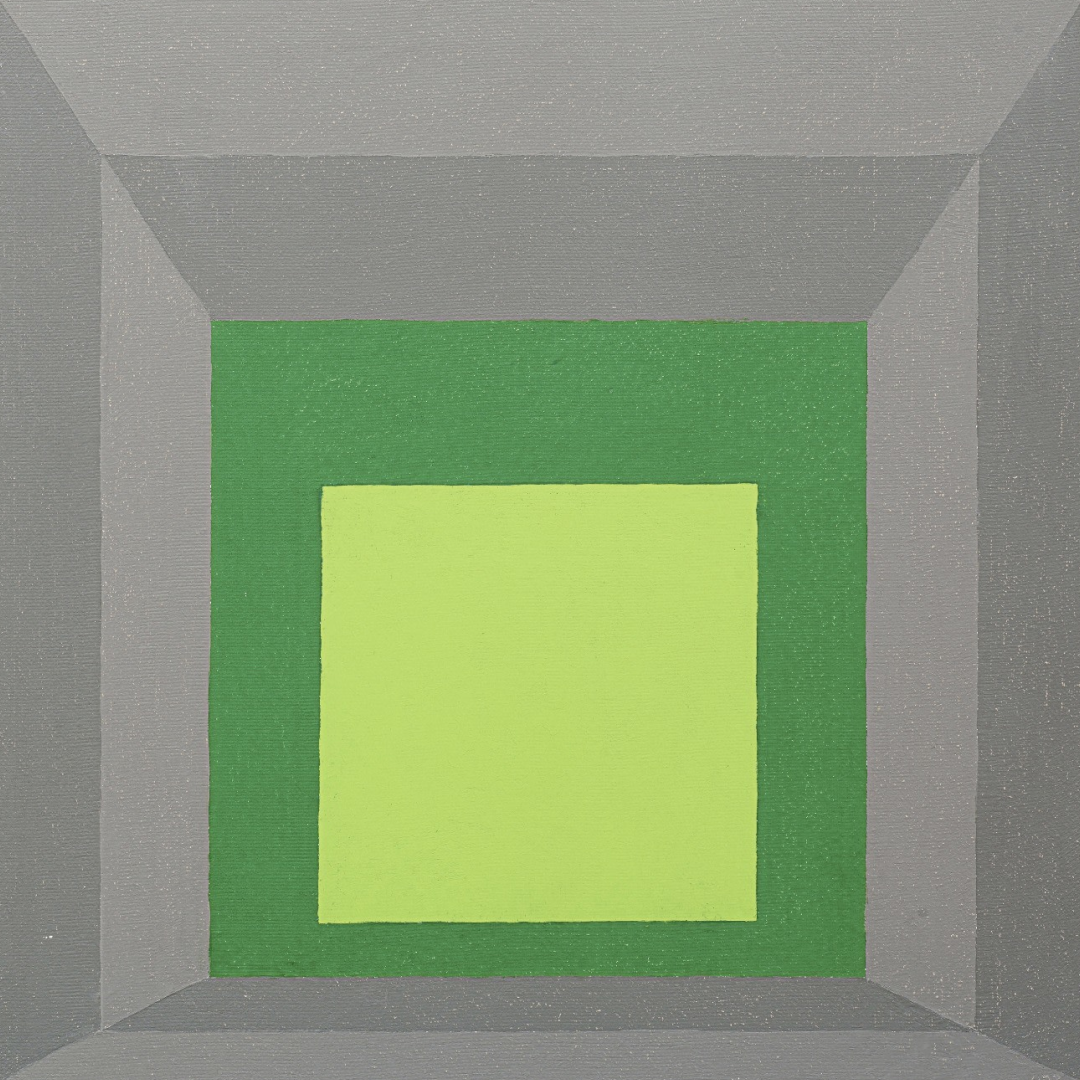

Interview by Inna Logunova Photo courtesy of the Leila Heller Gallery Featured image: Josef Albers, Study to the Homage to the Square: Juxtaposed, 1957